Disruptive Healthcare 2/2/2024: Alto Neuroscience IPO

Disruptive healthcare valuation, trends and analysis weekly. Always free. Subscribe:

Alto Neuroscience IPO:

This week my attention was on the IPO of one of our What If Ventures portfolio Companies, Alto Neuroscience. Alto (ticker “ANRO”) went public on Friday at a share price of $16.00. The stock opened for trading mid day at around $20 per share and ended the day at a price of $20.70 up 29.38% from the IPO price.

The IPO priced at the high end of the targeted range of $14 to $16 which was communicated by the underwriters earlier in the week. The IPO was highly over subscribed and ultimately the company raised more capital than anticipated because of this demand.

Why is this one so important to us?

I started What If Ventures for the purpose of funding mental health solutions that could help people like me. This investment in Alto Neuroscience really epitomizes what we are all about and why we exist.

Alto is redefining mental health and psychiatry by making precision medicine a reality in the mental health space. The Company has 4 lead drug candidates in clinical trials today focused on treating Depression, PTSD, Schizophrenia, and Bipolar Depression.

I am also particularly proud of this investment because of our history with the Company. I met the founder, Amit Etkin in February 2020 and spent over a year begging him to let me invest in Alto Neuroscience. I set a calendar reminder to email him every month for nearly a year and a half. Finally, he decided it was time to take on venture money and I introduced him to the firm that led the Series-A.

What If Ventures wrote our biggest check to date into that April 2021 Series-A round (a check that almost eclipsed our entire investing amount from the prior calendar year).

Then in 2022, we followed on in the Series-B, when the biotech market was crashing and nobody wanted anything to do with private company biotech investing. Finally, in November 2023, we followed on again in the Series-C (crossover round with Point72, Eli Lilly and Company, Franklin Templeton, and others) making Alto Neuroscience one of our most significant holdings.

So it's a bit of an understatement to say that we're excited. 😁

If you're not familiar with Alto Neuroscience, the company is a clinical-stage biopharmaceutical company on a mission to redefine psychiatry by leveraging neurobiology to develop personalized and highly effective treatment options. Building on more than a decade of research by founder, Dr. Amit Etkin, Alto aims to deeply understand brain function and match patients to the right medication more efficiently using treatments that, if approved, are tailored to specific patient populations.

As a result, Alto believes they can help patients avoid the often lengthy process of trying multiple ineffective treatments before finding one to which they respond, potentially helping patients get better faster. This is truly giving hope to people who have never had a real solution. This company will absolutely drive lasting change in how we treat mental health indications.

And that’s enough of me shamelessly plugging our portfolio company. I promise I won’t make a habit of this. Let’s get down to the data you came here to see…

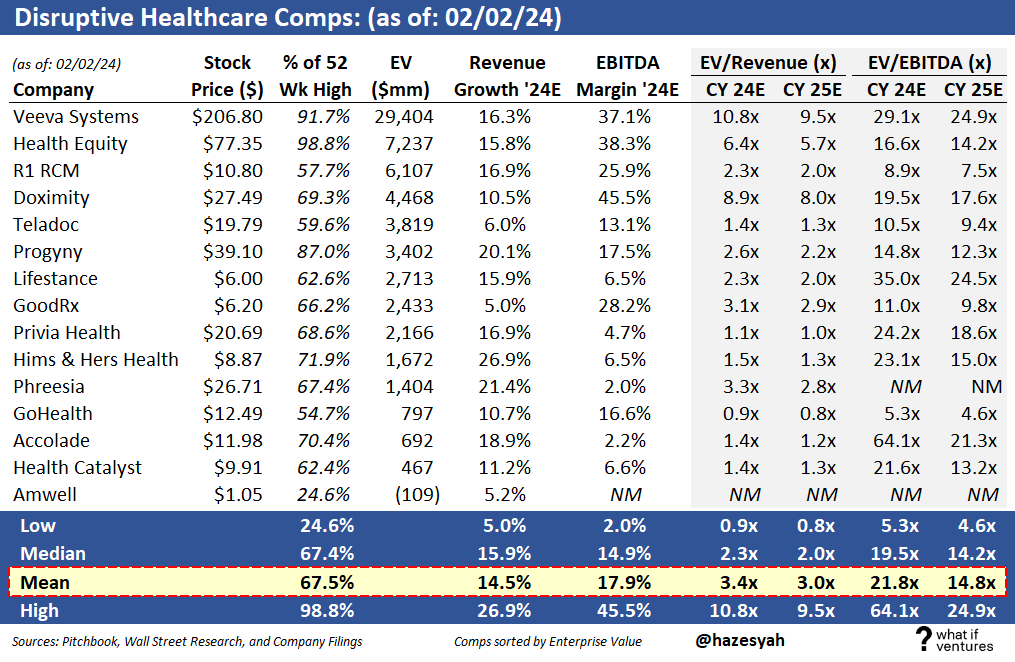

Disruptive Healthcare Public Comps:

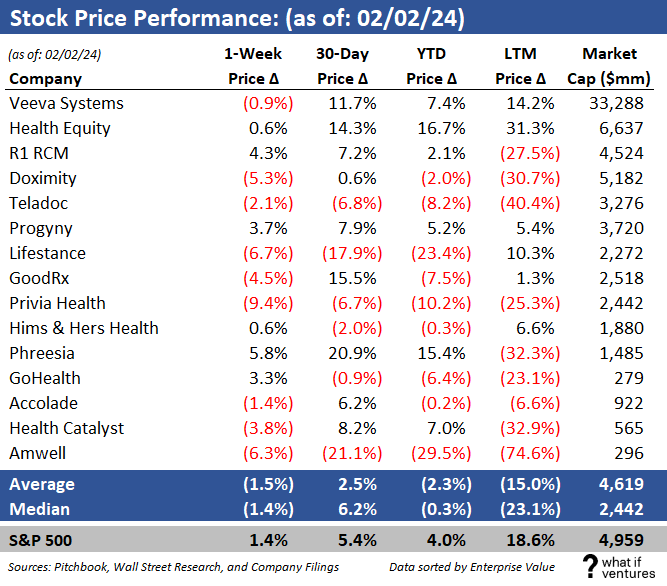

Comps Weekly Share Price Performance:

Valuation — EV / NTM Revenue:

Mature healthcare comps are generally valued based on their earnings (see the broader comps at the bottom of this post). However, earlier stage businesses such as startups, and to an extent these younger, disruptive healthcare public companies often don’t have positive earnings yet or they may have positive earnings but they haven’t reached the margin profile they will achieve upon maturity as a business. As a result, it’s harder to compare these companies on an apples to apples basis using EV to earnings. So, we use EV/NTM revenue to compare these companies on a relative basis to each other and to themselves over time.

Summary EV / NTM Revenue Valuation Stats:

5 Year Average: 7.1x

Today: 3.4x

Peak: 14.1x

Trough: 2.5x

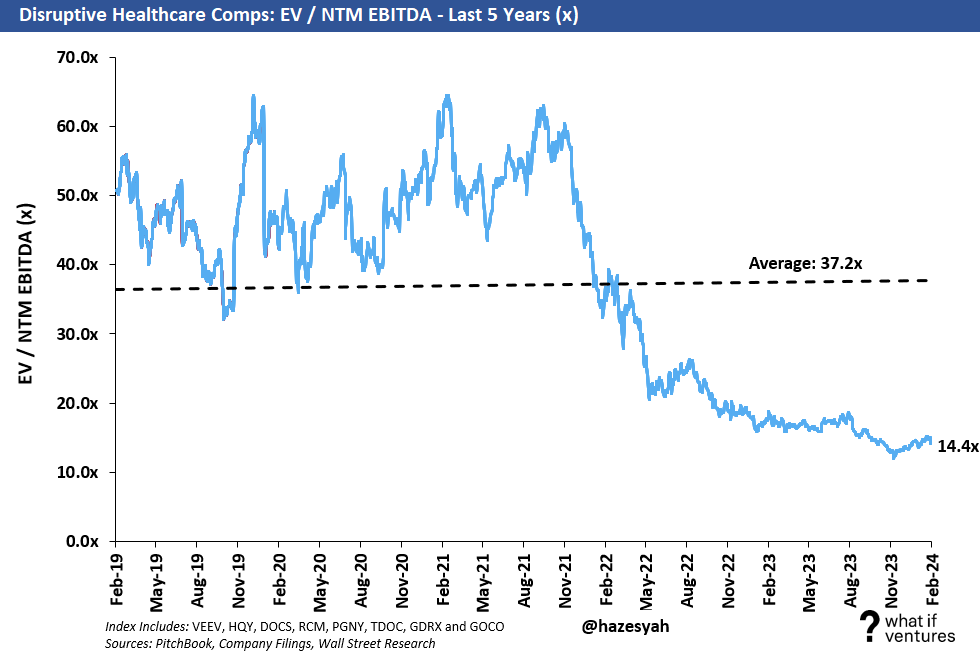

Valuation — EV / NTM EBITDA:

It’s a little bit harder to value the earlier cycle businesses on an EV / NTM EBITDA, but it’s worth considering the data point. Only 7 of these 15 companies had positive EBITDA in 2023, or barely positive EBITDA. The ones with barely positive EBITDA yield EBITDA multiples that aren’t realistic (so we consider them not meaningful “NM”). To create an index, I only include the peers who have a substantial believable positive EBITDA forecast for 2024 based on the average of Wall Street equity research reports. Those companies include: VEEV, HQY, DOCS, RCM, PGNY, TDOC, GDRX and GOCO. That’s not to say the other Companies won’t have positive EBITDA in 2024, but the multiples are relevant right now. Here’s how the chart looks.

Summary EV / NTM EBITDA Valuation Stats:

5 Year Average: 37.2x

Today: 14.4x

Peak: 64.4x

Trough: 12.0x

As these companies mature and begin to trade on EBITDA multiples or even P/E multiples (much like the hospital facilities and MCO peers) then this chart will tell us more. This is certainly a data point we can look at for profitable growth equity stage private companies. I’d expect those companies to be valued closer to the 5-year average or slightly lower. Some of that data in 2019 and 2020 is elevated because the EBITDA estimates back then were very small or barely positive for some of these companies driving an artificially high multiple that wasn’t driving valuation but rather was a dependent variable.

Stock Price Trends:

In the stock price charts below we compare the Disruptive Healthcare peers to the S&P 500 and the XLV over various time horizons. For those that aren’t familiar, the XLV is the S&P500 healthcare ETF which includes a wide mix of companies in the health care equipment and supplies, health care providers and services, biotechnology, and pharmaceuticals industries. Some companies in the XLV include Johnson & Johnson, Pfizer, UnitedHealth, AbbVie and Eli Lilly and their peers.

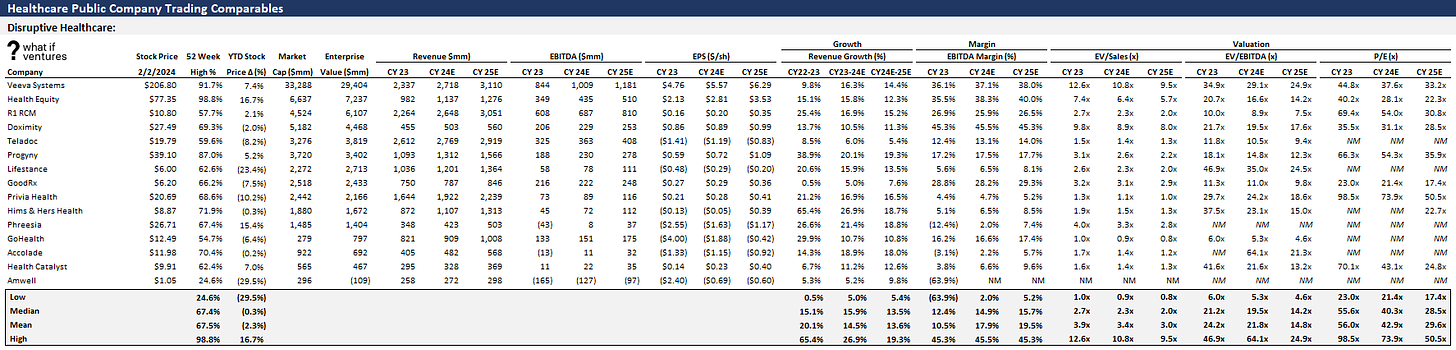

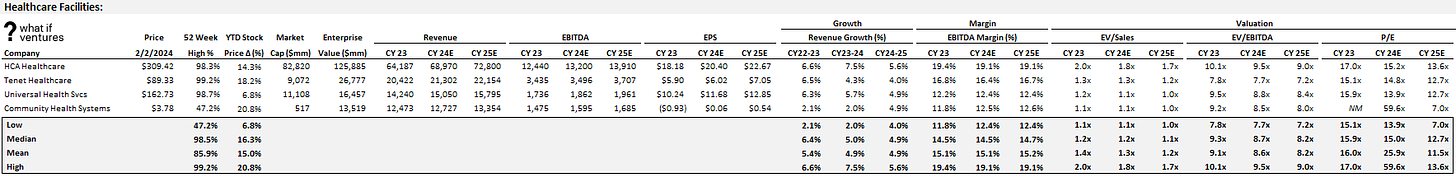

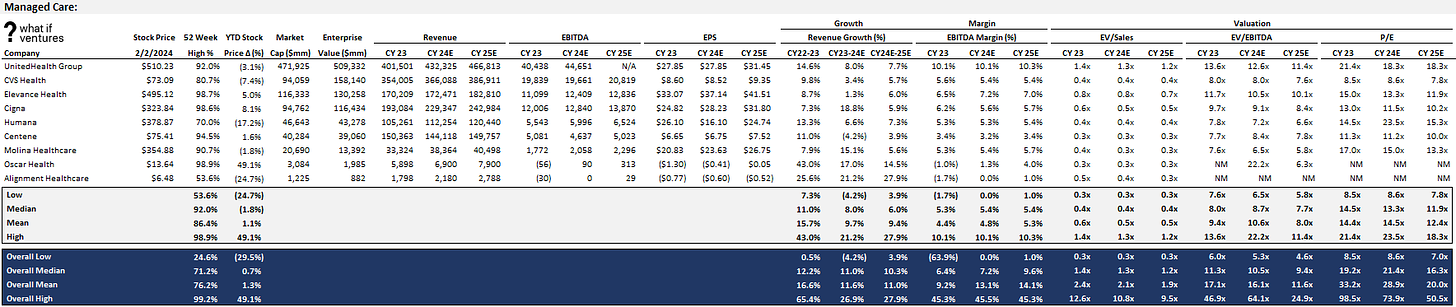

Broader Healthcare Comps Set as of 2/2/2024:

This newsletter is mostly focused on the disruptive healthcare comps and how their performance drives valuation for our private market portfolio at What If Ventures. However, we do keep a much broader set of comps that includes Healthcare Facilities and Managed Care Organizations. We will start sharing that broader data set weekly here. I know the font is small, but you should be able to click on these and expand.

^I realized this is too small to read, but if you double click on the image it should expand.

I hope this is helpful!

If you would like to receive weekly updates on this data and our outlook on the Disruptive Healthcare market, then please subscribe and share our work with a friend.

About What If Ventures — What If Ventures invests in mental health and digital health startups from seed stage to growth equity. To date, we have invested over $80mm into 67 healthcare startups since January 2020.

If you have questions about any of this analysis or want to collaborate with What If Ventures, please reach out via info@whatif.vc. We’d love to connect with entrepreneurs and investors in the space.

You can follow more of my commentary on twitter here: @hazesyah