Disruptive healthcare valuation, trends and analysis weekly. Always free. Subscribe:

Healthcare IPOs are Back

The IPO market is back! Or that’s what we’re hoping for. There were 3 healthcare IPOs this week. Two biotech companies who both saw their stock trade up after pricing, and one services business who saw their stock drop after pricing.

For those hoping to see the IPO window open to start bringing liquidity back to the market, your wish was granted. Exactly how open that window is and for how long, remains to be seen.

The IPOs this week included:

CG Oncology (S-1, IPO Press) - Late-stage clinical biopharmaceutical company focused on developing and commercializing a potential backbone bladder-sparing therapeutic for patients afflicted with bladder cancer.

ArriVent (S-1, IPO Press) - Clinical-stage biopharmaceutical company dedicated to the identification, development and commercialization of differentiated medicines to address the unmet medical needs of patients with cancer.

BrightSpring Health Services (S-1, IPO Press) - Leading home and community-based healthcare services platform, focused on delivering complementary pharmacy and provider services to complex patients.

IPO 1-Day Stock Price Performance:

The Biotech market has been completely abandoned by institutional investors over the last two years. It’s definitely a positive sign to see such strong bids for two biotech stocks so early in the newly opened IPO cycle. Let’s hope that momentum continues in the weeks to come as the market works through a backlog of planned IPOs.

Now, let’s take a look at how our publicly traded disruptive healthcare comps universe performed this week.

Disruptive Healthcare Public Comps:

Comps Weekly Share Price Performance:

Valuation - EV / NTM Revenue:

Mature healthcare comps are generally valued based on their earnings (see the broader comps at the bottom of this post). However, earlier stage businesses such as startups, and to an extent these younger, disruptive healthcare public companies often don’t have positive earnings yet or they may have positive earnings but they haven’t reached the margin profile they will achieve upon maturity as a business. As a result, it’s harder to compare these companies on an apples to apples basis using EV to earnings. So, we use EV/NTM revenue to compare these companies on a relative basis to each other and to themselves over time.

Summary EV / NTM Revenue Valuation Stats:

5 Year Average: 6.6x

Today: 3.4x

Peak: 14.1x

Trough: 2.5x

Valuation — EV / NTM EBITDA:

I received a comment last week about looking at these companies on an EV / NTM EBITDA basis. The problem is that only 7 of these 15 companies had negative EBITDA in 2023, or barely positive EBITDA. The ones with barely positive EBITDA give off EBITDA multiples that aren’t realistic. So to create an index I only took the peers who had a substantial believable positive EBITDA forecast for 2024 based on the average of Wall Street equity research reports. Those companies include: VEEV, HQY, DOCS, RCM, PGNY, TDOC, GDRX and GOCO. That’s not to say the other Companies won’t have positive EBITDA in 2024, but the multiples are relevant right now. Here’s how the chart looks.

Summary EV / NTM EBITDA Valuation Stats:

5 Year Average: 37.3x

Today: 14.8x

Peak: 64.4x

Trough: 12.0x

As these companies mature and begin to trade on EBITDA multiples or even P/E multiples (much like the hospital facilities and MCO peers) then this chart will tell us more. This is certainly a data point we can look at for profitable growth equity stage private companies. I’d expect those companies to be valued closer to the 5-year average or slightly lower. Some of that data in 2019 and 2020 is elevated because the EBITDA estimates back then were very small or barely positive for some of these companies driving an artificially high multiple that wasn’t driving valuation but rather was a dependent variable.

Stock Price Trends:

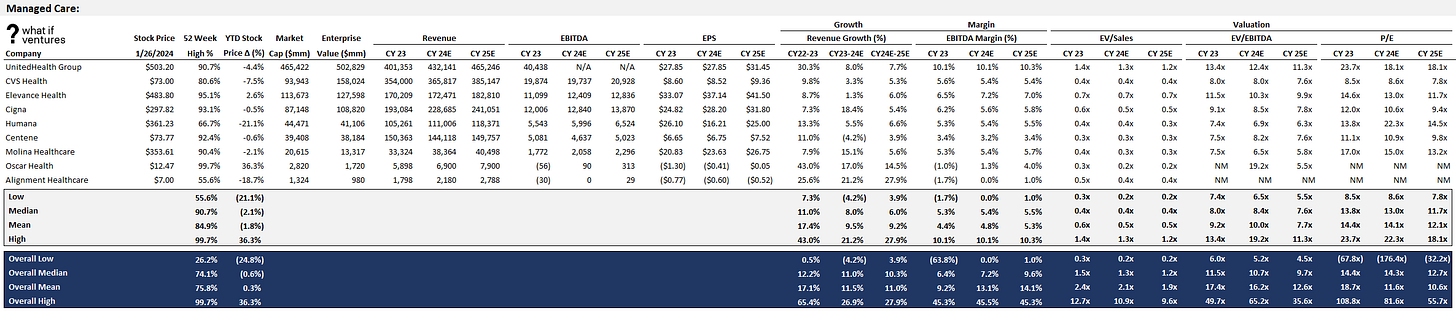

Broader Healthcare Comps Set

This newsletter is mostly focused on the disruptive healthcare comps and how their performance drives valuation for our private market portfolio at What If Ventures. However, we do keep a much broader set of comps that includes Healthcare Facilities and Managed Care Organizations. We will start sharing that broader data set weekly here. I know the font is small, but you should be able to click on these and expand.

^I realized this is too small to read, but if you double click on the image it should expand.

I hope this is helpful!

If you would like to receive weekly updates on this data and our outlook on the Disruptive Healthcare market, then please subscribe and share our work with a friend.

About What If Ventures — What If Ventures invests in mental health and digital health startups from seed stage to growth equity. To date, we have invested over $80mm into 67 healthcare startups since January 2020.

If you have questions about any of this analysis or want to collaborate with What If Ventures, please reach out via info@whatif.vc. We’d love to connect with entrepreneurs and investors in the space.

You can follow more of my commentary on twitter here: @hazesyah