Disruptive Healthcare 1/10/2025 - Digital Health M&A is Back, Possibly...

M&A is back. Or is it? What does it mean?

Disruptive healthcare valuation, trends and analysis. Weekly/Monhtly-ish.

As a startup investor, it’s always nice to see M&A trades in our sector. It could be a harbinger of buyside demand and a path to exits / liquidity for others in our sector. It also could be a one-off deal that doesn’t signal anything. Who knows?

What we can do is analyze the deal and read valuation metrics across to other hopeful transactions in the sector.

Transcarent (private company) announced that it entered into a definitive agreement to acquire Accolade (ACCD) for $7.03 per share in cash (a 110% premium over ACCD’s closing price on January 7th). This price represents an equity value of $621mm and based on ACCD’s latest balance sheet, I estimate an enterprise value of about $598mm.

At $598mm EV, the multiples on this deal are interesting:

1.1x CY 2025E Revenue

1.0x CY 2026E Revenue

20x CY 2025E EBITDA

10x CY 2026E EBITDA

The transaction has already been approved by both Boards of Directors.

And to level set, Transcarent offers a similar product to Accolade in the Navigation space known as “WayFinding” for a $5 PEPM. The transaction is expected to close during Q2.

The combined company will offer solutions to more than 1,400 employer and payer clients as Transcarent’s WayFinding solutions and care experiences combine with ACCD’s Advocacy, Expert Medical Opinion (2nd.MD), and Primary Care (PlushCare) offerings.

The only question left to ask is if anyone else will try to come in and offer a higher price. We don’t think so. It’s highly likely that ACCD, due to various internal dynamics, has been shopping this deal and any PE buyers wouldn’t be able to get to the synergies needed to make a higher price make sense nor be able to push leverage multiples to a range that drive higher returns sensibly. It wouldn’t make sense for an insurance company to step in here and any other strategic has probably already passed. We will see how it works out. I have doubts for a variety of reasons both strategic in nature and based on who is in charge.

Now back to our regular valuation update on the Disruptive HC Peers…

Disruptive Healthcare Public Comps:

Our Disruptive Healthcare peer group is currently trading at 3.6x 2025E revenue and 3.2x 2026E revenue.

Top 4 Revenue Multiples:

This top 4 group is a subset of the broader disruptive healthcare peer set. These 4 currently have the greatest EV / 2025 Revenue multiples of the broader group. These 4 companies as a group trade at 8.8x 2025E revenue versus the broader group at 3.6x. This group also boasts an average EBITDA margin of 37.0% on 2025E projections versus the broader group at 18.7% 2025E EBITDA margin.

Disruptive HC Peer Stock Price Performance:

Our peer group has lagged the XLV and the S&P500 for the last 12 months. Toward the end of November, our peer group bumped up against the XLV on an LTM basis and even surpassed the XLV and has maintained that slight lead recently.

Peer performance vs. broader market over the last 12 months:

Peer performance vs. broader market over the last 1 week:

The ACCD M&A deal juiced our peer group’s returns this week versus the market.

Stock Price Performance by Company:

Valuation — EV / NTM Revenue:

Mature healthcare comps are generally valued based on their earnings (see the broader comps at the bottom of this post). However, earlier stage businesses such as startups, and to an extent these younger, disruptive healthcare public companies often don’t have positive earnings yet or they may have positive earnings, but they haven’t reached the margin profile they will achieve upon maturity as a business. As a result, it’s harder to compare these companies on an apples-to-apples basis using EV to earnings. So, we use EV/NTM revenue to triangulate valuation for these companies and for startups in similar markets.

Summary of EV / NTM Revenue Valuation Stats:

5 Year Average: 6.3x

Today: 3.6x

Peak: 16.0x

Trough: 2.4x

Summary of top 4 EV / NTM Revenue Valuation Stats:

5 Year Average: 10.7x

Today: 8.8x

Peak: 21.9x

Trough: 5.5x

Valuation — EV / NTM EBITDA:

We were previously only looking at 8 companies from the perspective of EV/NTM EBITDA, but since Q1 earnings have reported, more analysts are projecting positive EBITDA in 2024 and beyond for more of the peers so we have expanded the index here to include 10 of the 16 companies. Based on what I’m seeing in equity research I think we will be adding a few names to this list soon as more of our peer group is starting to approach profitability.

To create an index, I only include the peers who have a substantial believable positive NTM EBITDA forecast based on the average of Wall Street equity research reports. The comps with barely positive EBITDA yield EBITDA multiples that aren’t realistic (so we consider them not meaningful “NM”).

The included companies are: VEEV, HQY, DOCS, PGNY, TDOC, GDRX, GOCO, HIMS, LFST, and PRVA. That’s not to say the other Companies won’t have positive EBITDA in 2024, but the multiples are relevant right now. Here’s how the chart looks.

Summary EV / NTM EBITDA Valuation Stats:

5 Year Average: 35.1x

Today: 16.9x

Peak: 85.0x

Trough: 14.6x

As these companies mature and begin to trade on EBITDA multiples or even P/E multiples (much like the hospital facilities and MCO peers) then this chart will tell us more. This is certainly a data point we can look at for profitable growth equity stage private companies. I’d expect those companies to be valued closer to the 5-year average or slightly lower. Some of that data in 2019 and 2020 is elevated because the EBITDA estimates back then were very small or barely positive for some of these companies driving an artificially high multiple that wasn’t driving valuation but rather was a dependent variable.

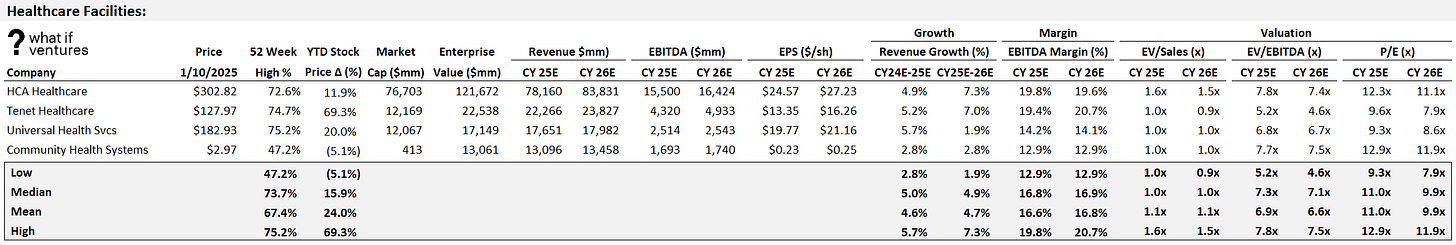

Broader Healthcare Comps as of 1/10/2025:

This newsletter is mostly focused on the disruptive healthcare comps and how their performance drives valuation for our private market portfolio at What If Ventures. However, we do keep a much broader set of comps that includes Healthcare Facilities and Managed Care Organizations.

If you would like to receive weekly updates on this data and our outlook on the Disruptive Healthcare market, then please subscribe and share our work with a friend.

About What If Ventures — What If Ventures invests in mental health and digital health startups from seed stage to growth equity. To date, we have invested over $100mm into 85 (mostly) healthcare startups since January 2020. The firm is actively managed by Stephen Hays.

If you have questions about any of this analysis or want to collaborate with What If Ventures, please reach out via info@whatif.vc. We’d love to connect with entrepreneurs and investors in the space.

You can follow more of Stephen’s commentary on twitter here: @hazesyah

Really insightful breakdown! The 110% premium on Accolade feels like a strong signal. EBITDA margins still catching up across the sector, how long do you expect valuations to stay this compressed compared to the 5-year averages?